Touching A New High

Knight Frank India’s half-yearly report on Indian real estate highlights the continued resurgence of the residential segment in H1 2024

The real estate industry has experienced a broad-based recovery across all segments since the pandemic, but the residential market has arguably seen the swiftest and steepest resurgence among all real estate segments.

According to a recently released report by Knight Frank India, sales volumes in the primary market have grown at an extremely healthy annualised rate of 29% since 2020 and culminated in a 10-year high in 2023. “Market sentiments have been very positive largely due to an upbeat economic outlook with GDP growth rates at the highest levels in the world. India continues to stand out as a shining example of growth in an otherwise inflationary environment in the backdrop of a volatile global geopolitical scenario caused by the Israel-Palestine and Russia-Ukraine wars,” reasoned the report.

Analysing the force behind the rally in the real estate segment in the last couple of years and what is fuelling further growth, Shishir Baijal, Chairman and Managing Director, Knight Frank India opined, “Central government’s third term promises continuity in growth initiatives, bolstering economic stability. This strong growth momentum, amidst an improving global outlook, underscores the positive economic sentiment prevailing in the country and is reflected in the robust performance of the Indian real estate markets.”

An Uptick in Residential Sales

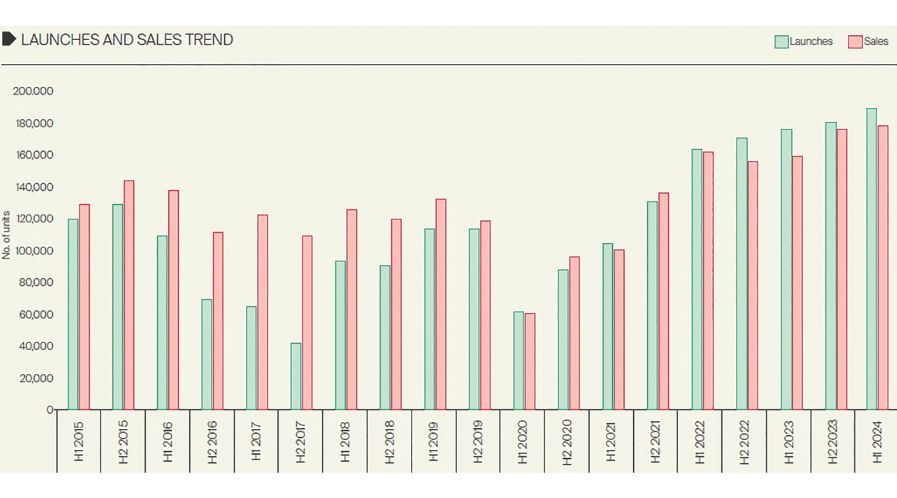

The residential market has continued to strengthen, with demand reaching an 11-year high during H1 2024. The 0.17 mn units sold in H1 2024 represent a healthy 11% growth in YoY terms. While the headline demand figures convey a narrative of resilient growth, the underlying components are undergoing significant changes. “Increased savings during lockdowns, minimal income disruptions in mid and high-income brackets, and a robust economic growth forecast have fuelled demand in the residential real estate market in India,” noted the report.

The report further highlighted that sales have grown across all markets in YoY terms with the exception of NCR which shows a drop of 4% YoY. “However, it must be noted that the base period of H1 2023 represented an 11-year high in terms of sales. Most markets are currently at multi-year highs, and Hyderabad scaled a new all-time high in H1 2024 with 18,573 units sold during the period. Home sales in Mumbai also stand at a 13-year high with 47,259 units sold in H1 2024 constituting a healthy 16% YoY growth. This was fuelled primarily by the 117% spike in the sale of units priced over INR 10 mn compared to the same period last year.”

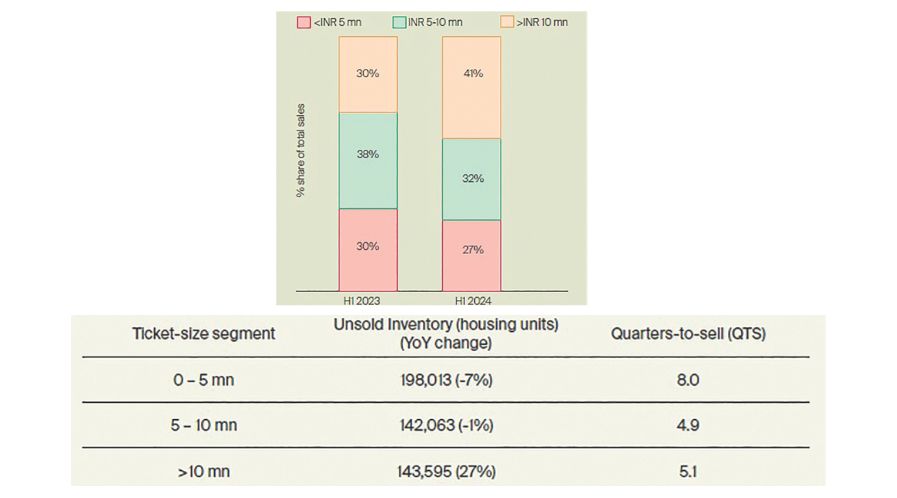

A Shift Towards Premiumisation Baijal asserted, “A notable shift toward premiumisation has taken root in the residential market, with higher-priced homes driving market volumes. Premium housing products priced over INR 10 million have emerged as the largest segment, accounting for 41% of sales across all the eight markets under our coverage and experiencing the most growth during this period.” Sales in this segment have grown by 51% YoY and it has been the primary driver for overall sales growth during H1 2024. Sales in the INR 5-10 mn and <INR 5 mn categories have dropped by 8% and 6% YoY respectively as homebuyer focus has shifted to the premium-priced category during this period.

“The drop in the mid-segment sales can be viewed as a normal correction within a longer-term upward trend. However, the deceleration in the sale of units priced under INR 5 mn has sustained for the past five half-yearly periods and it has been the only segment that has not seen any growth in an otherwise strong market. Increasing prices, higher home loan rates and the comparatively adverse impact of the pandemic on homebuyers in this segment continued to weigh on demand,” reasoned the report.

Launches and Market Health Development activity has also scaled up to tap into the rich vein of demand that the residential market is currently seeing. According to the report, the 0.18 mn units launched in H1 2024 represent a 10-year high in terms of units launched in a half-yearly period. Developers are well attuned to the changing preferences of homebuyers who are now leaning significantly toward experiential living, squarely aimed at an upgraded lifestyle. “The share of the number of units launched in the >INR 10 mn ticket size category grew from 36% in H1 2023 to 47% in H1 2024.”

Unlike the office market, supply levels have exceeded sales very significantly and consistently since the beginning of 2022. “This has caused unsold inventories to build up gradually in the market, growing by 3% YoY in H1 2024. While total inventory build-up might not seem significant, growing inventory in the >INR 10 mn category has been a cause for concern among market stakeholders in recent months. Inventory levels in this segment have grown by a substantial 27% YoY in H1 2024 and warrant a closer look in terms of an assessment of whether the market is on the verge of a correction.”

While the rising inventory level can seem like a matter of concern when viewed in isolation, it must be seen in conjunction with the sales velocity to depict a more accurate picture of market health. Interestingly, the quarters-to-sell (QTS) level for the eight markets has been falling consistently despite growing inventory levels. “It has fallen from 9.5 in H1 2021 to 5.9 quarters (less than 18 months) in H1 2024 and depicts a market with improving fundamentals despite increasing inventory. The QTS level of the premium category depicts a healthier image at 5.1 quarters, clearly showing that the rising inventory in this segment is still not a pressing issue for the residential market,” noted the report.

Baijal opined that while there are increasing instances of developers enticing homebuyers with financing schemes and other freebies such as zero floor rise, etc., their ability to move inventory remains strong, especially at the top end of the market. The report forecasted, “The sales volumes achieved in the first half of the year despite the general elections being conducted in Q2 2024 showcases the strong undercurrent of demand in the market. The optimistic economic outlook and interest rate scenario with the possibility of rate cuts provide further headroom for demand. With the basic fundamentals in place, the market looks well positioned to exceed the sales volumes of 2023 as it heads towards the festive season in H2 2024.”

Tags: Indian Real Estate, Knight Frank India, Real Estate Trends, Residential Market