A Shift Towards Premiumisation

Knight Frank India’s quarterly report on Indian real estate highlights the continued resurgence of the premium residential segment in Q3 2024.

The Indian economy continues to gain strength as the outlook for the global economy improves gradually. With inflation numbers coming down to 3.65% in August 2024 and the RBI’s upward revision of the FY 2025 GDP growth forecast at 7.2%, India is all but certain to maintain its pole position as the fastest-growing large economy in the world.

According to a recently released report by real estate consulting firm Knight Frank India that takes stock of the Indian residential and office market in Q3 2024, the stable interest rates since early 2023 and a strong economic outlook have kept homebuyer sentiments buoyant and demand robust in 2024.

Continuing the Upward Surge

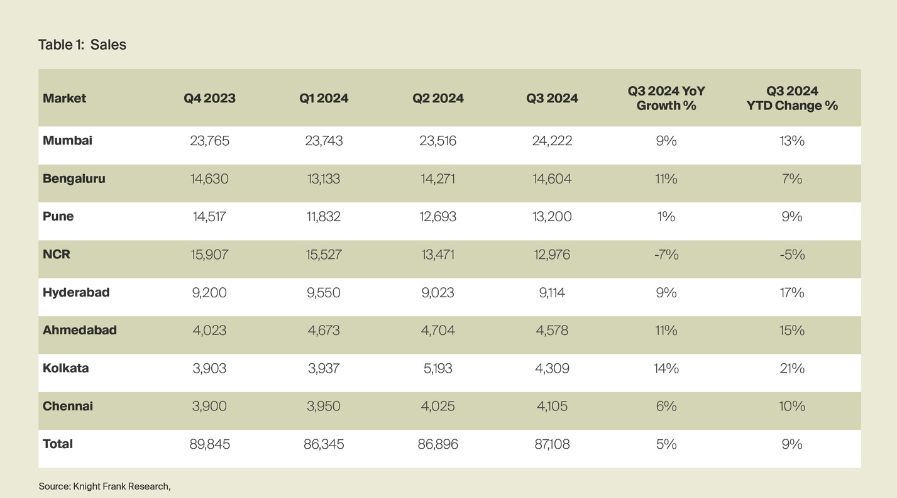

Momentum in the residential market has trended up well in 2024 with Q3 2024 recording the highest quarterly sales this year at 87,108 units. “This works out to a 5% higher level in YoY terms and a more significant 9% higher level when compared in YTD terms,” noted the report.

Sales have grown across all markets except for the NCR where sales have dipped by 7% YoY and 5% in YTD terms. “NCR has historically been among the more speculative markets with a relatively higher quantum of investment interest. This, coupled with very low inventory levels in mid and affordable categories in the right locations, weighed down sales in the market,” reasoned the report further adding that the top end of the market with units priced over Rs 10 mn, continues to grow at a healthy pace. As per the Knight Frank India report, the highest sales volumes were recorded in Mumbai at 24,222 units which is a new high for the market. Among the larger markets, sales grew the most in Bengaluru, at 11% YoY with 14,604 units.

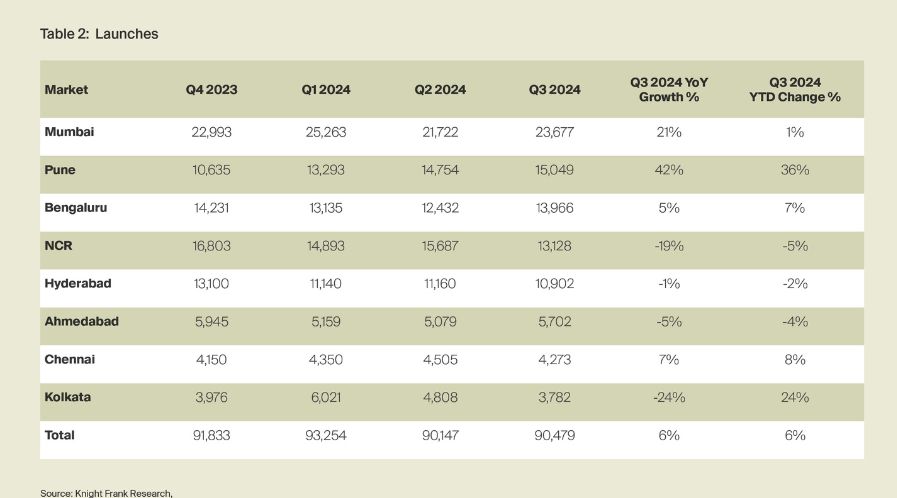

The steady growth in demand is surpassed by the volume of units launched, exceeding sales for the past eight quarters. “90,479 units were launched in Q3 2024 which constitutes a 6% growth over the previous period. The Pune market saw the most growth during the quarter at 42% YoY. Mumbai and Pune saw the highest volume of units launched in Q3 2024 and together constituted 43% of the units launched during the quarter,” noted the report.

Premium Segment Takes Precedence

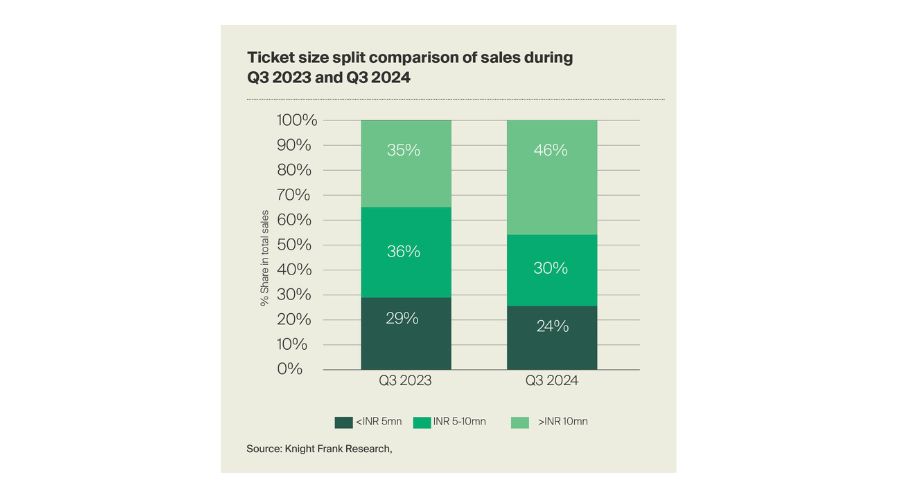

Consistent with the upward trend seen in the past 13 quarters, the share of sales in the ` 10 mn and above ticket size grew significantly to 46% in Q3 2024, compared to 35% a year ago, as per the report data.

The report attributes this continuous surge to the growing need for larger living spaces and an upgraded lifestyle, which was sparked during the pandemic, and continues to fuel demand. “Sales in this segment have grown by 41% YoY and have been the primary driver for overall sales growth during the quarter. Sales in the Rs 5-10 mn and <Rs 5 mn categories have dropped by 14% and 13% YoY respectively as homebuyer focus shifted to the premium category during the quarter,” noted the report.

While the top end of the market is firing on all cylinders, the affordable segment has consistently lost market share since the pandemic. “Sales in this segment constituted 24% of the total sales compared to 29% in Q3 2023 and fell 14% since then. Mumbai and Kolkata are the only markets where sales in the affordable segment have grown in YoY terms,” highlighted the report.

While rising prices have kept homebuyers away from the market in this price-sensitive segment, the lack of supply has also played a significant role in curtailing sales volumes. “This is manifested in the fact that in contrast to the overall market where supply in the premium segment exceeded sales in nine of the past 10 quarters, supply lagged sales over the past 13 quarters in the affordable segment for units priced under Rs 5 mn,” explained the report.

It further added that the higher margins and homebuyer interest existing in the highest segment has attracted the bulk of development interest (53%) in Q3 2024. “The mid-segment of units priced between Rs 5-10 mn is also experiencing some sluggishness due to this phenomenon with a sale drop of 13% YoY during the quarter,” noted the report.

The Residential Market Health

Homebuyers have been more inclined to acquire ready or near-ready inventory to minimise completion risks seen in the past periods, as per the report. The heightened demand over the past few quarters though has depleted the stock of older inventory, and consumers are now increasingly willing to acquire newly launched properties at relatively lower prices.

The report highlighted, “This is reflected in the average age of inventory decreasing to 14.9 quarters in Q3 2024 from 16.1 quarters during the year-ago period. “The unsold inventory level has increased 3% in YoY terms as fresh development activity has intensified. However, this must be read in conjunction with the sales momentum to arrive at a better assessment of market health.”

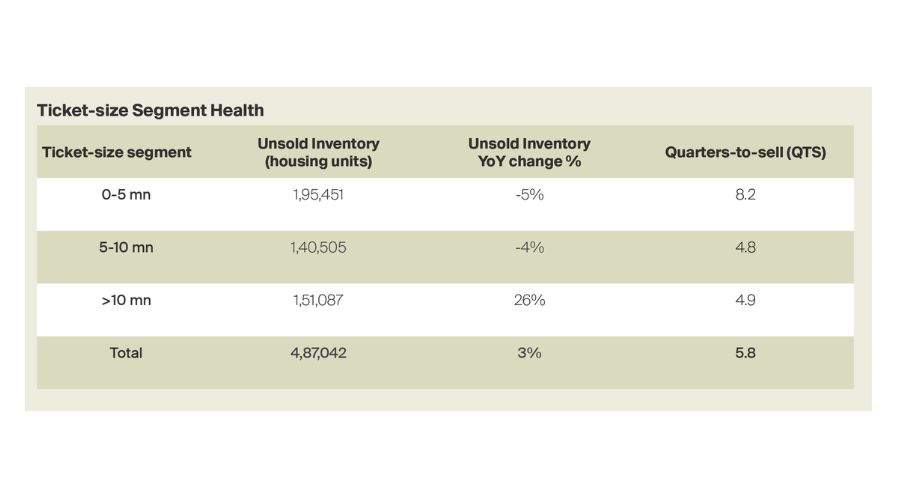

The QTS level represents the number of quarters required for the existing unsold inventory to be sold at the current rate of sales. A reducing QTS level depicts a market where demand is gathering momentum. “The current QTS level of 5.8 quarters which is significantly better than the 6.1 level a year ago, signifies that the overall market traction has improved despite the increase in unsold inventory levels,” noted the report.

Taking stock of ticket-size-wise market health, the report added, “While unsold inventory levels in the >Rs 5 mn segment have dropped 5% YoY in Q3 2024, the QTS level is higher than the market average at 8.2 quarters which is just over two years and still not very high, considering that it takes significantly longer to complete a residential project of reasonable scale in this segment. The QTS levels for the mid and premium segments stand at 4.8 and 4.9 quarters respectively.”

Given the steady economic outlook and the likelihood of rate cuts, the report predicts that the market demand has enough tailwinds to sustain the current momentum as the end of the year approaches.

Tags: Indian Real Estate, Knight Frank India, Real Estate Trends, Residential Market